up to $2000

up to $2000

up to $1100

$1500 in 5 Hours

Make $950 To $2200 Daily

$50 sign-up bonus

100%

100%

10%

$30 sign-up bonus

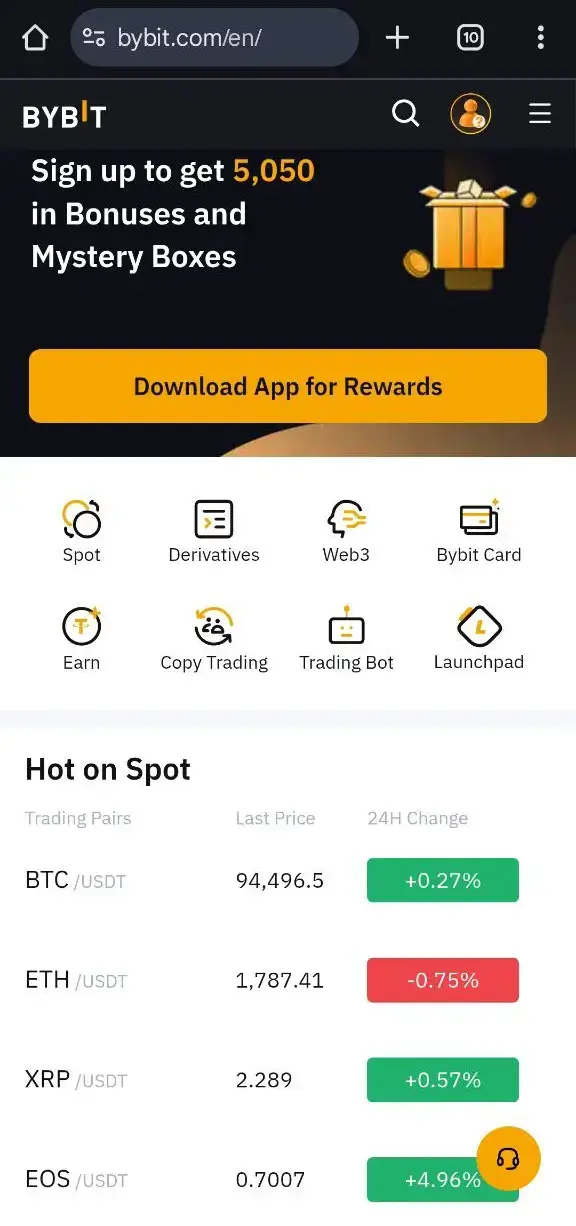

Bybit India, founded in 2018, has quickly become one of the leading crypto exchanges, attracting over 50 million users around the world. 5Is Bybit legal in India? Absolutely — in 2025, Bybit India officially registered with India’s FIU-IND , reinforcing its reputation as a trusted platform for local traders. For instance, although Bybit India serves Indian users, it operates internationally as a regulated Virtual Asset Service Provider (VASP) from its Dubai headquarters.

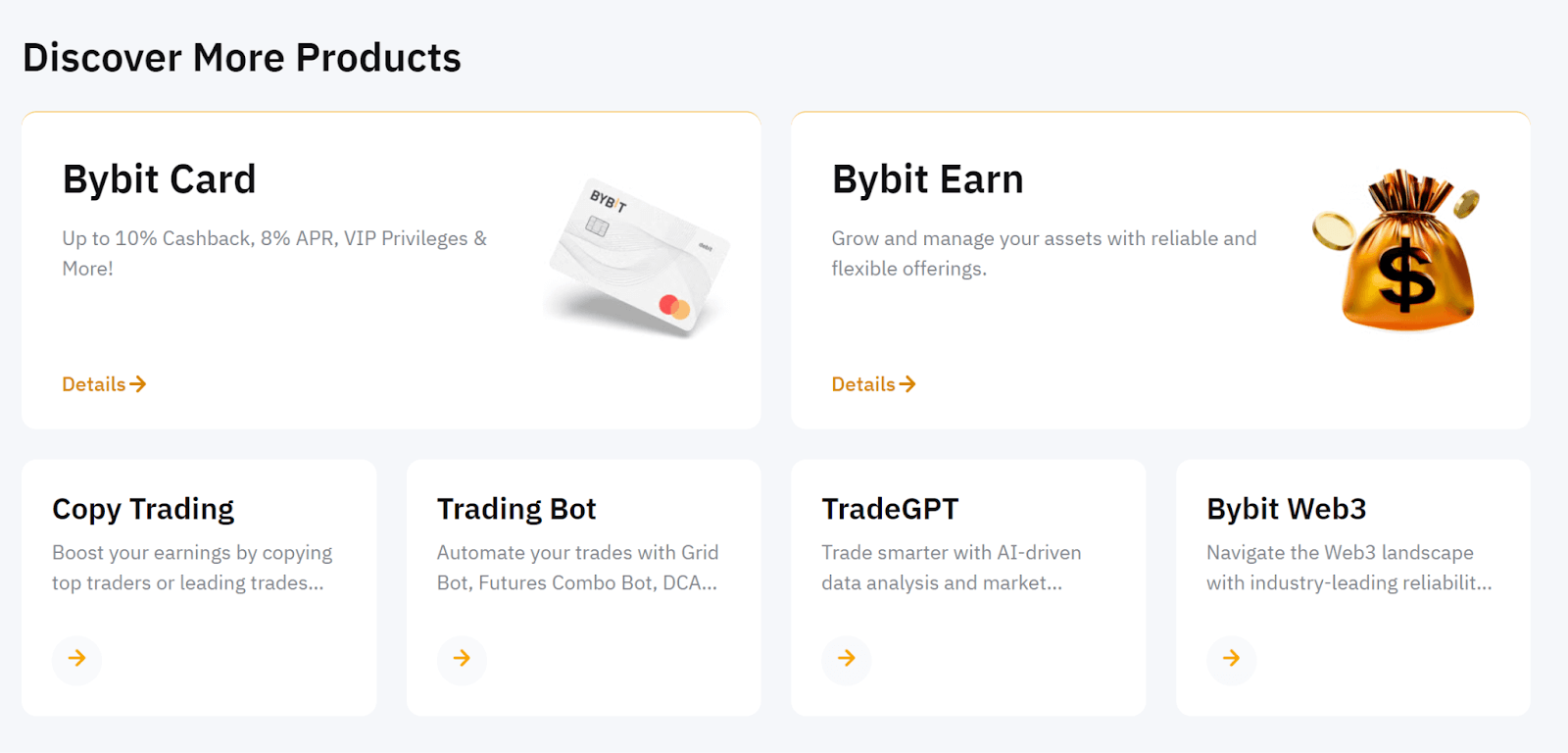

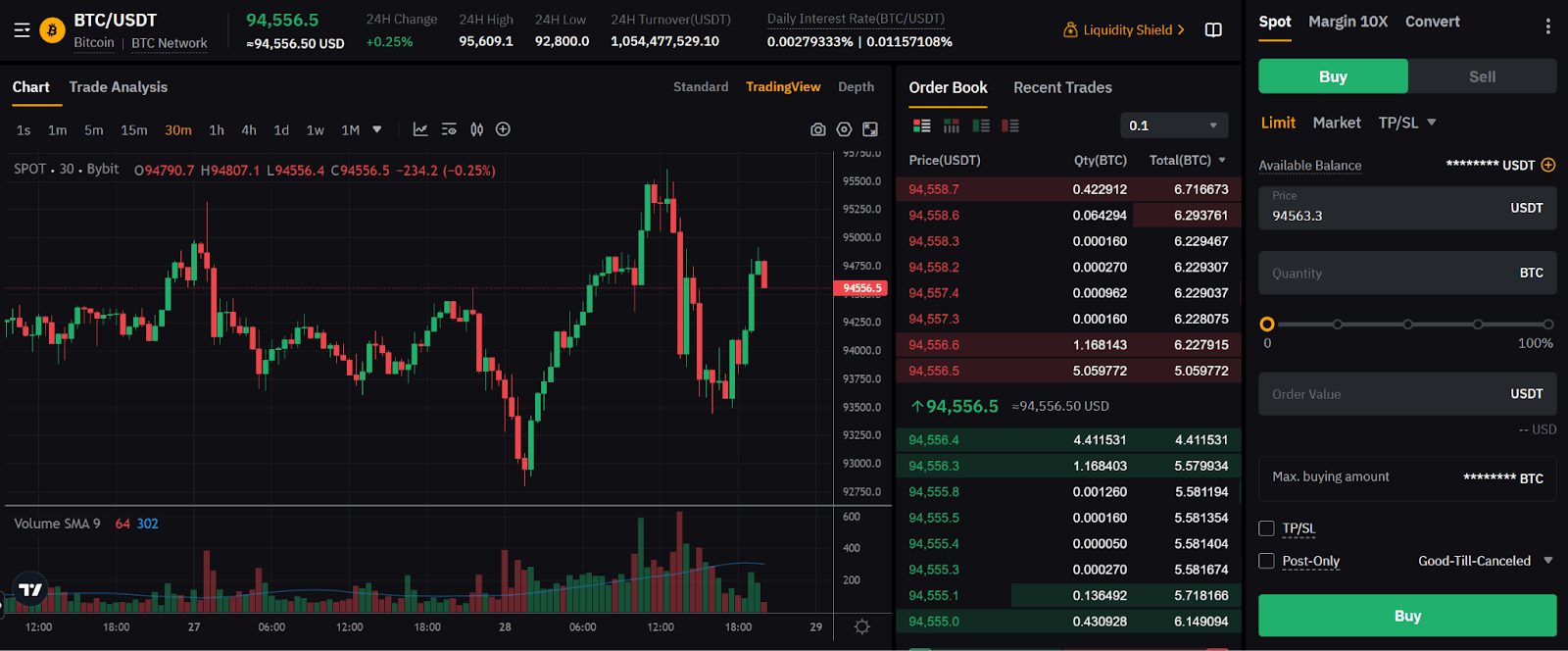

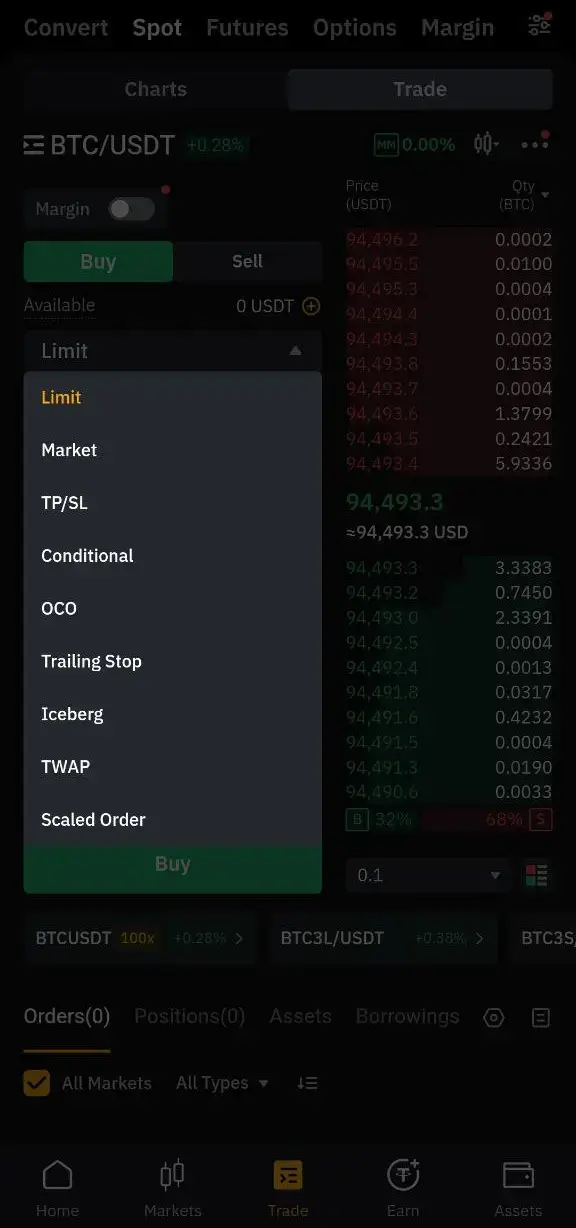

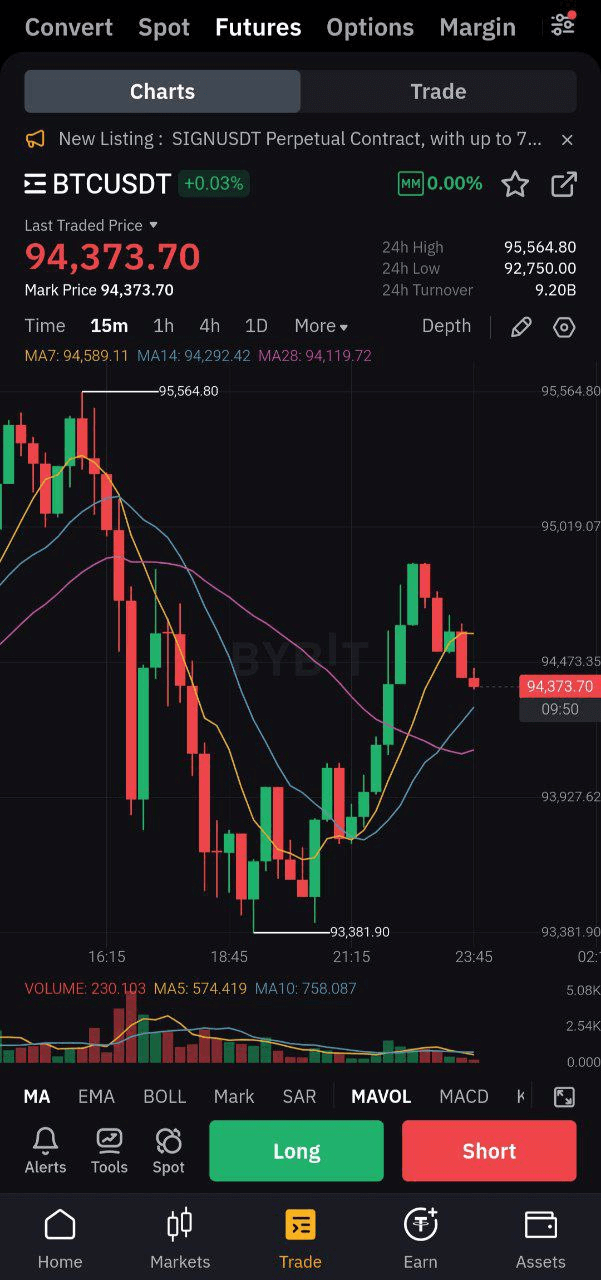

When it comes to trading options, Bybit India offers much more than just standard services. Users can access spot and futures trading with up to 100x leverage , making it suitable for both beginners and experienced traders. Moreover, features like copy trading make it easier for newcomers to start investing without deep technical knowledge. Depositing funds is also simple: Indian users can top up their accounts using INR via UPI or through P2P trading , ensuring fast and convenient transactions.

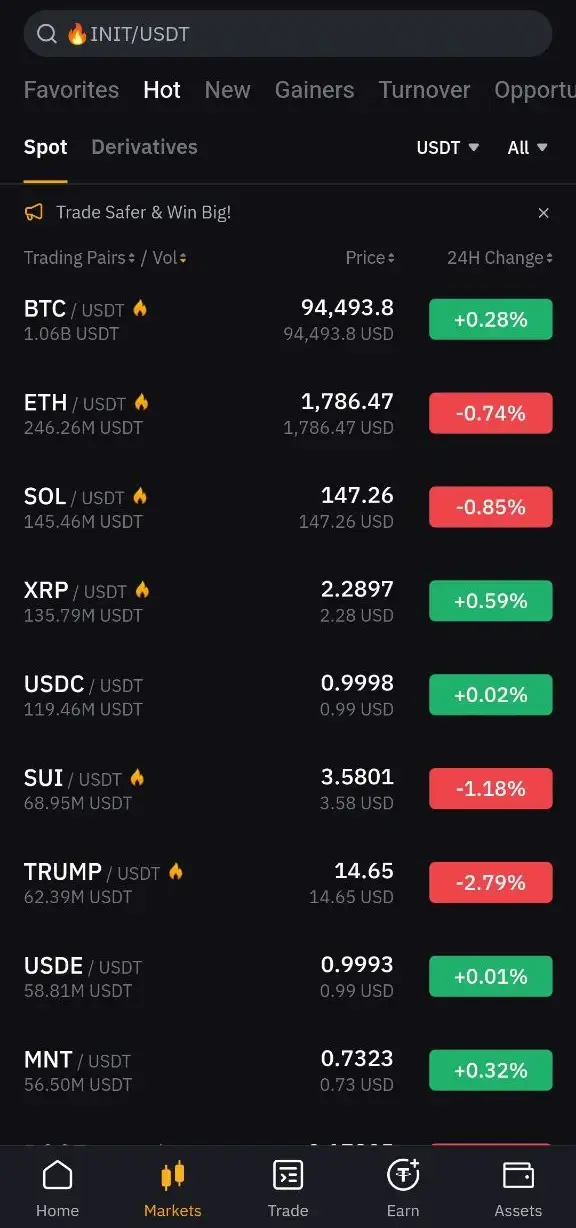

The Bybit trading app , available for both Android and iOS devices, provides real-time data, analytical tools, and an intuitive interface, which makes it an excellent choice for those starting their crypto journey in India. Thus, whether you are a beginner or looking to scale your trading activities, Bybit India has the necessary tools to support you.

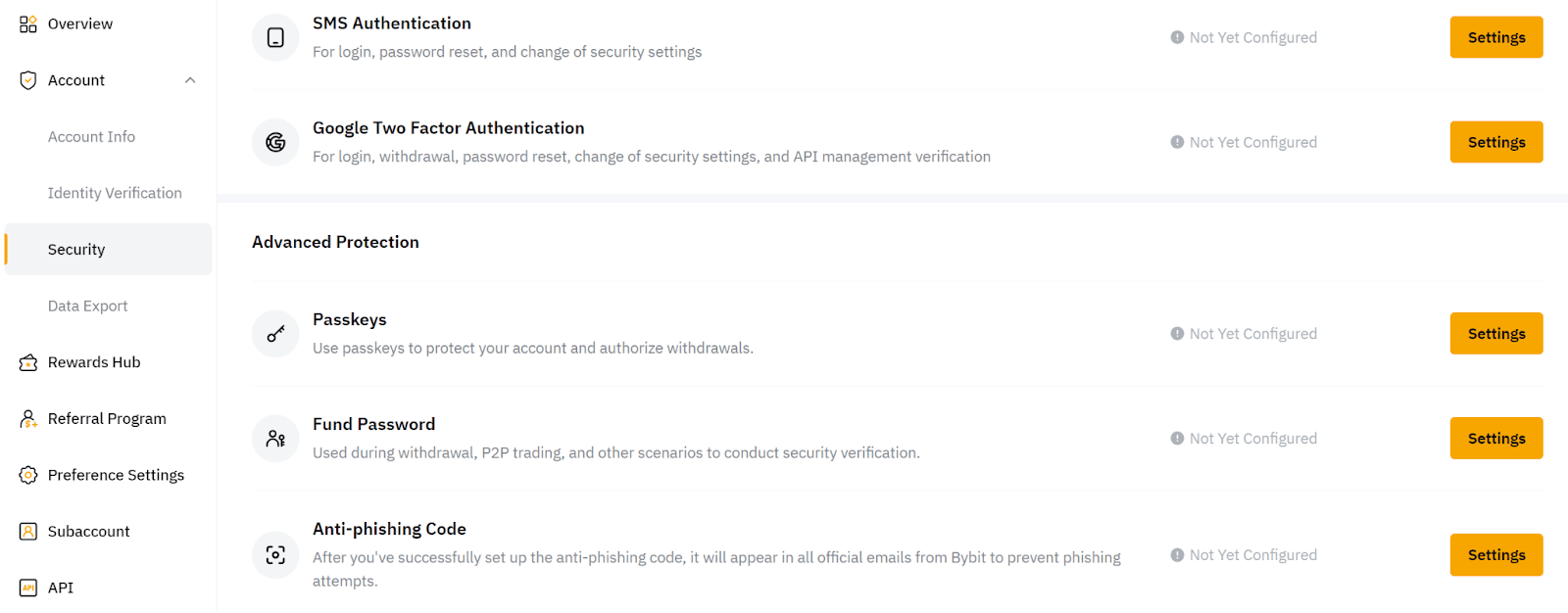

Security remains a top priority at Bybit India. The platform ensures user protection through Proof-of-Reserves audits, cold storage solutions , and two-factor authentication (2FA) . In addition to safety, Bybit India rewards its users through attractive welcome bonuses and a referral program , offering extra benefits to new and existing customers.

If you're wondering how to get started, learning how to use Bybit in India is straightforward, even for newcomers. Thanks to its low fees, excellent local support, and user-friendly services, many traders find Bybit India to be a better choice than alternatives like Binance and WazirX.

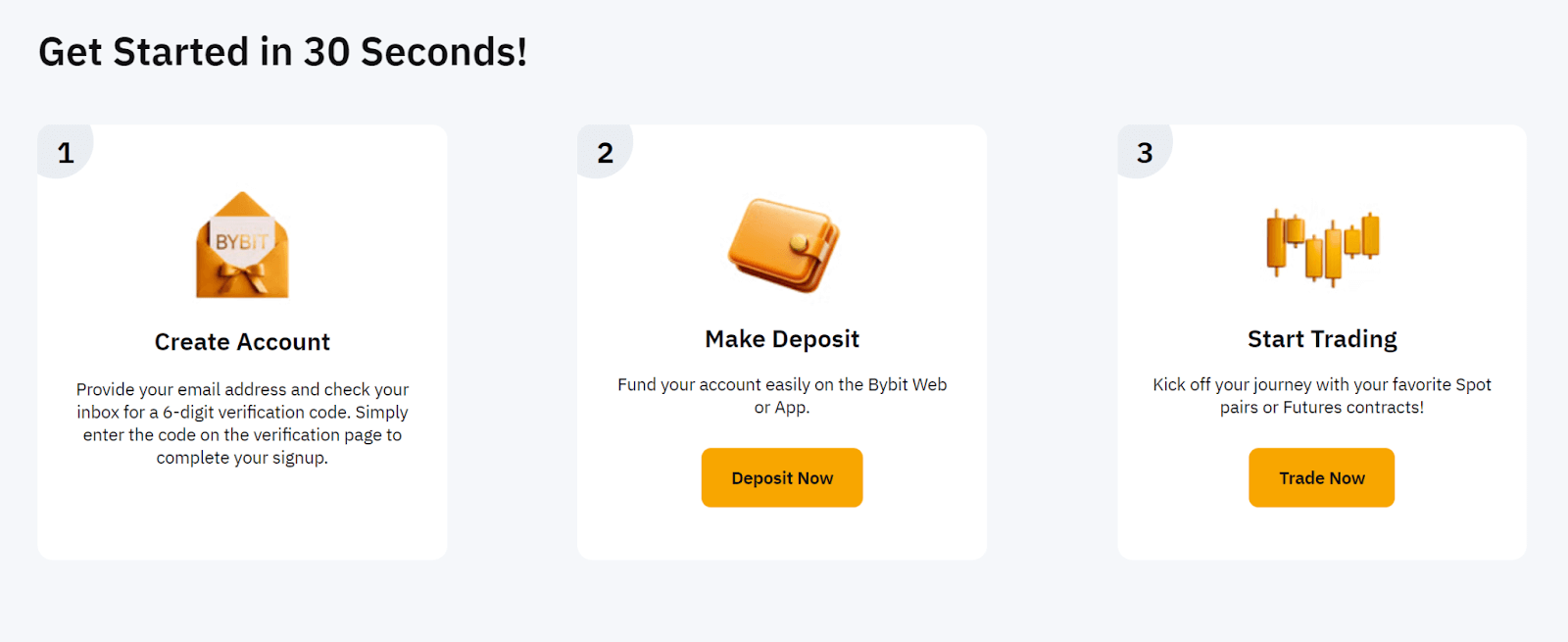

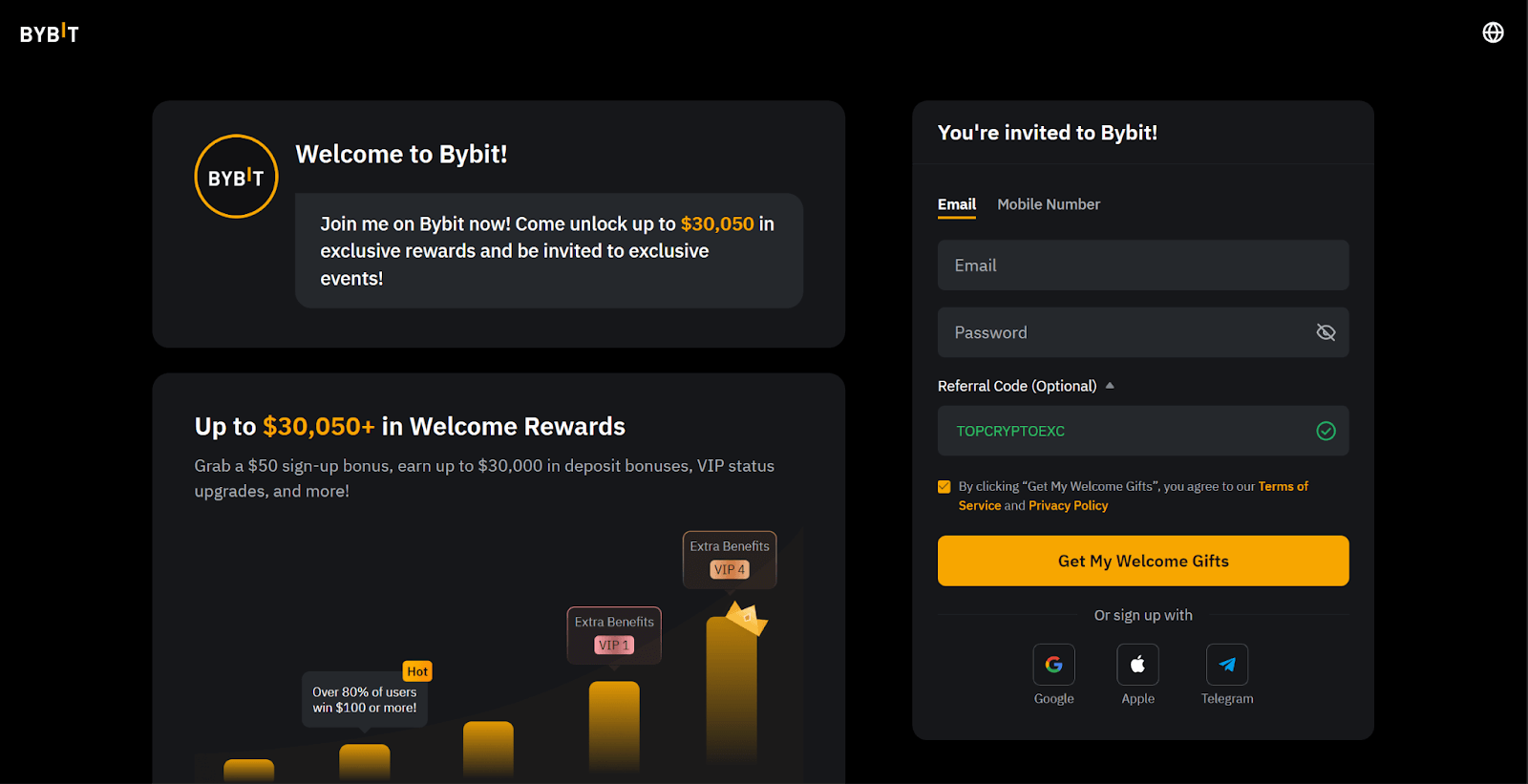

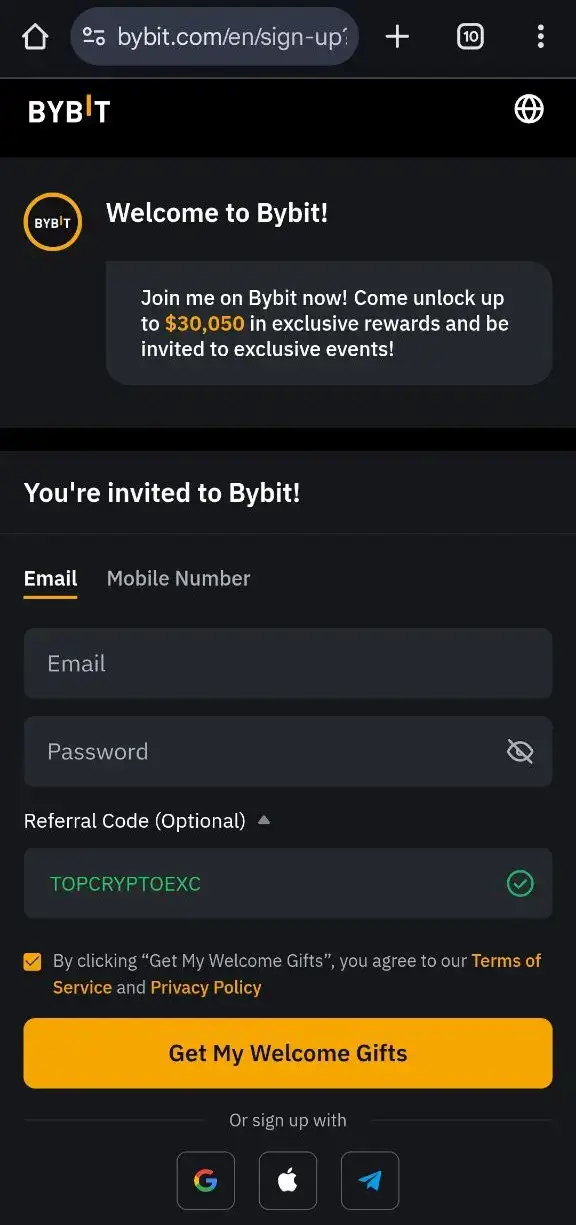

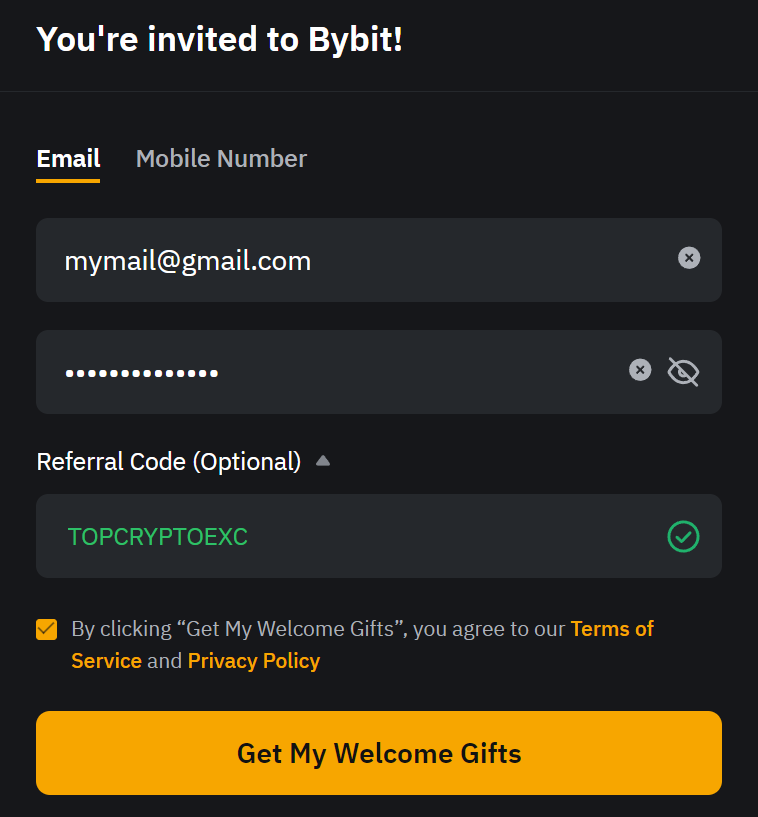

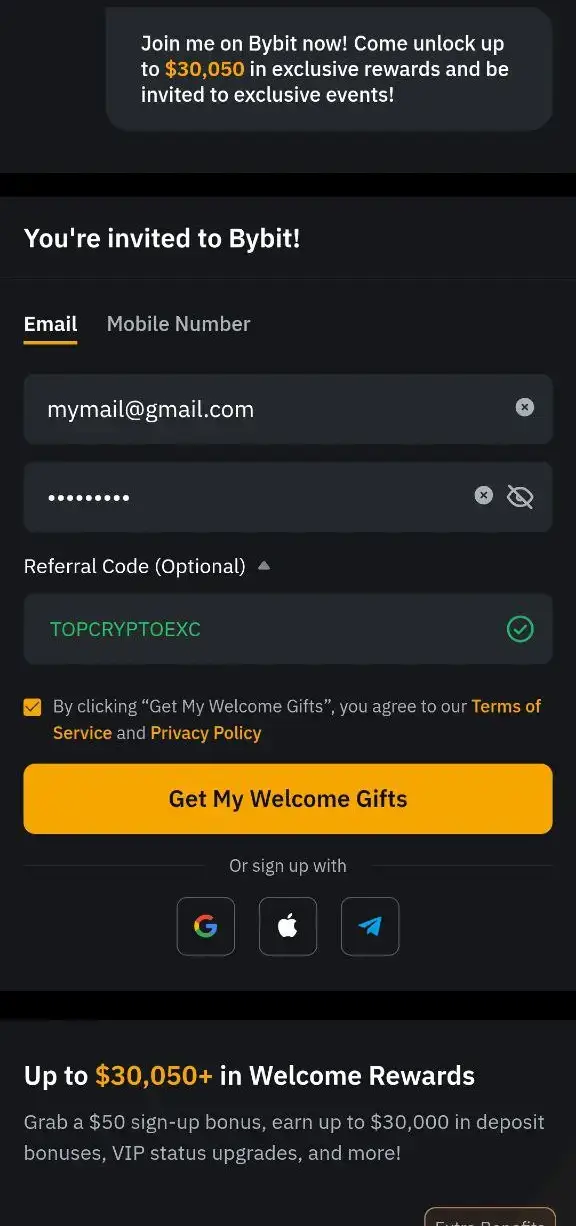

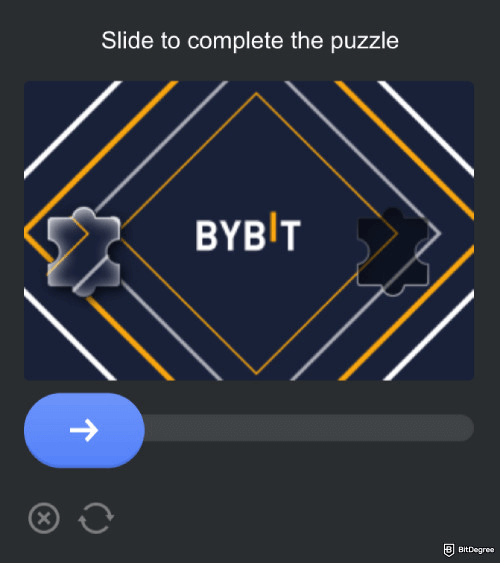

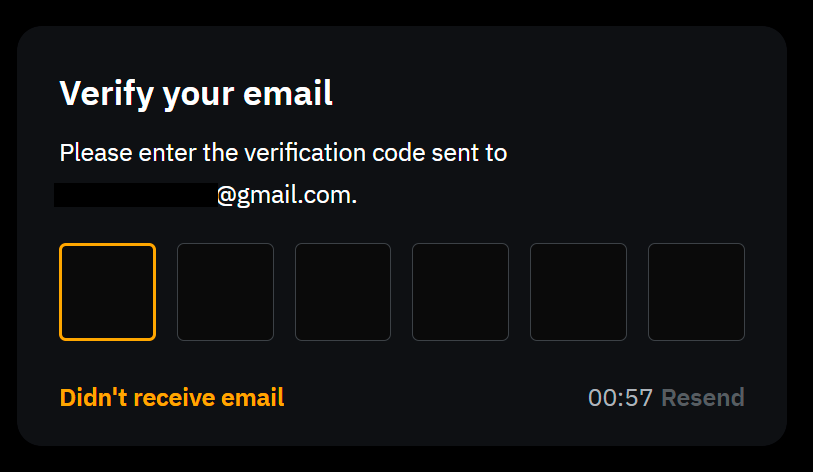

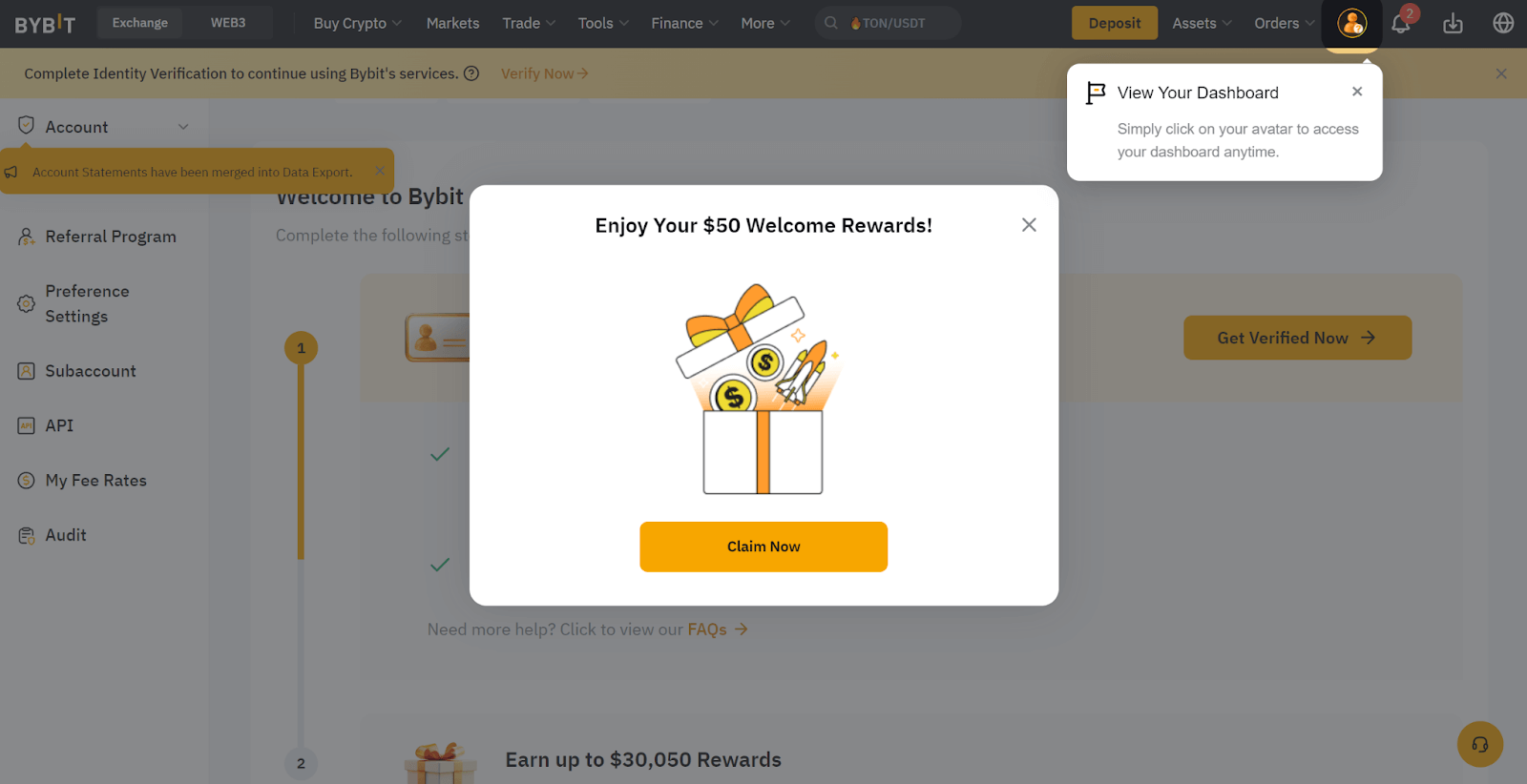

Bybit India offers a quick and easy registration process for Indian traders. Signing up is simple, and users can register using either an email address or mobile phone number. Here's a step-by-step guide to create your Bybit India account:

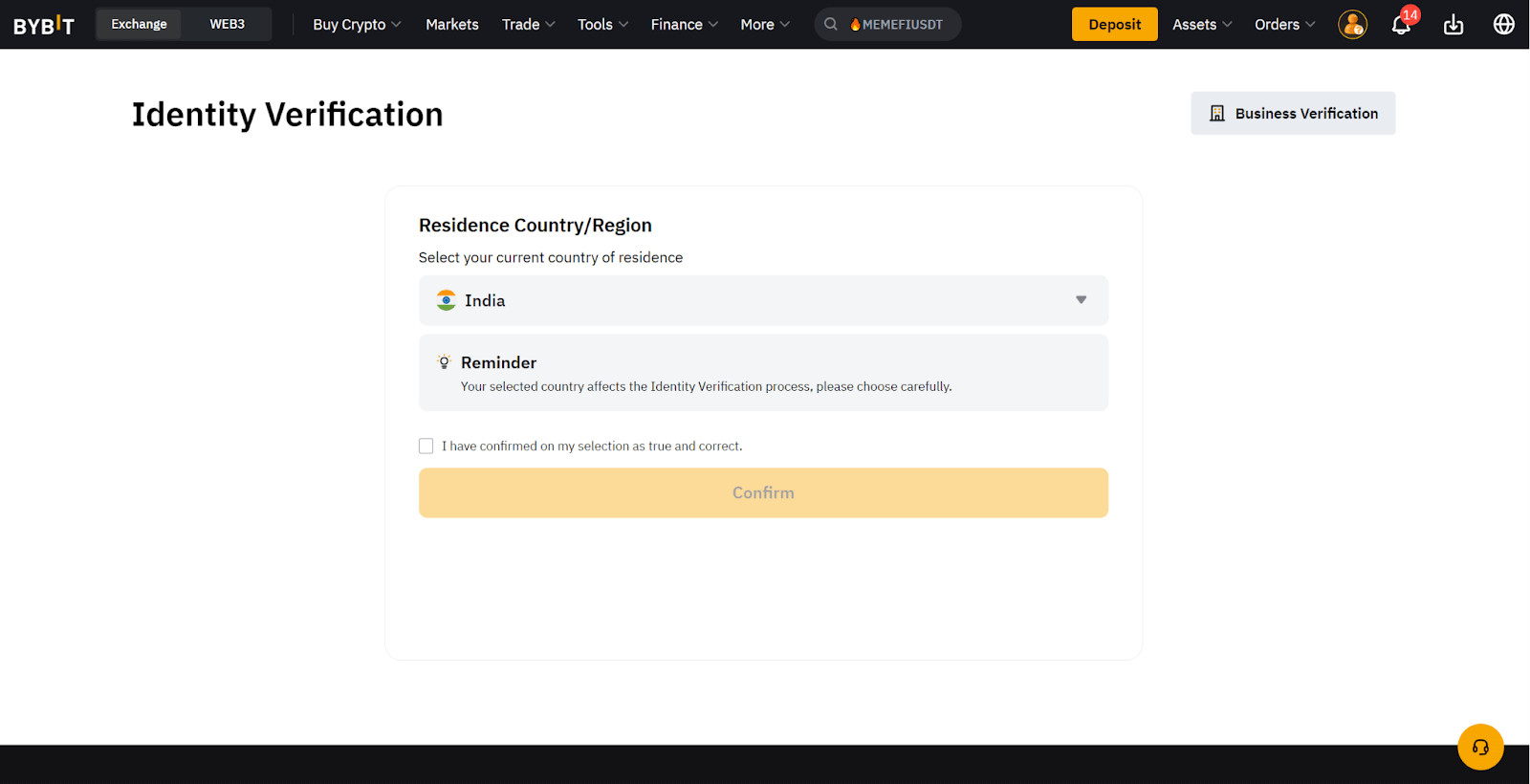

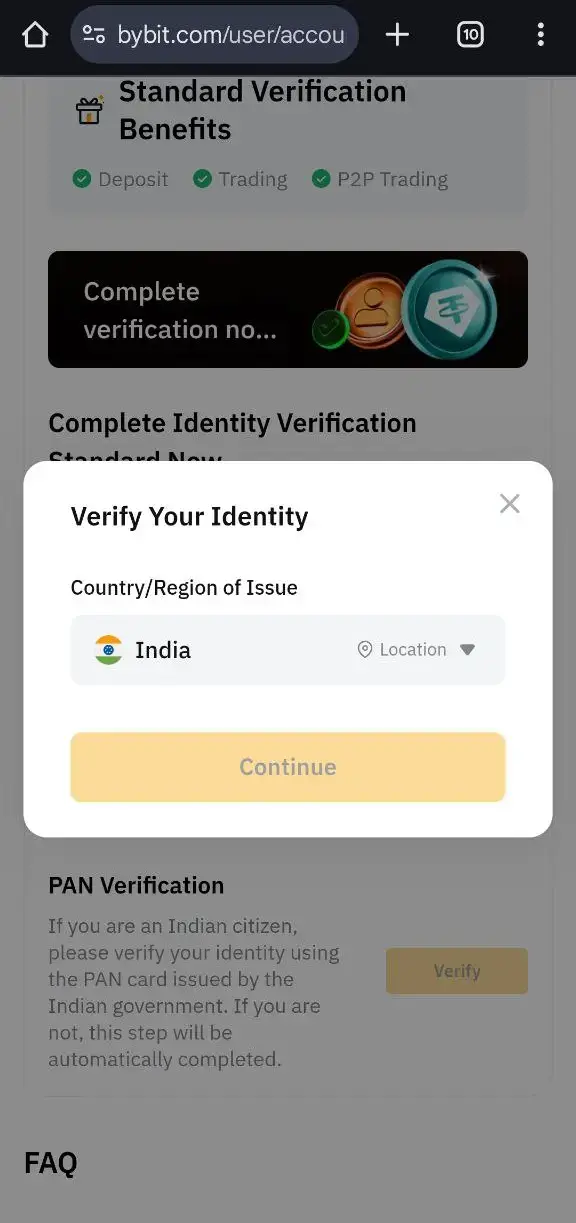

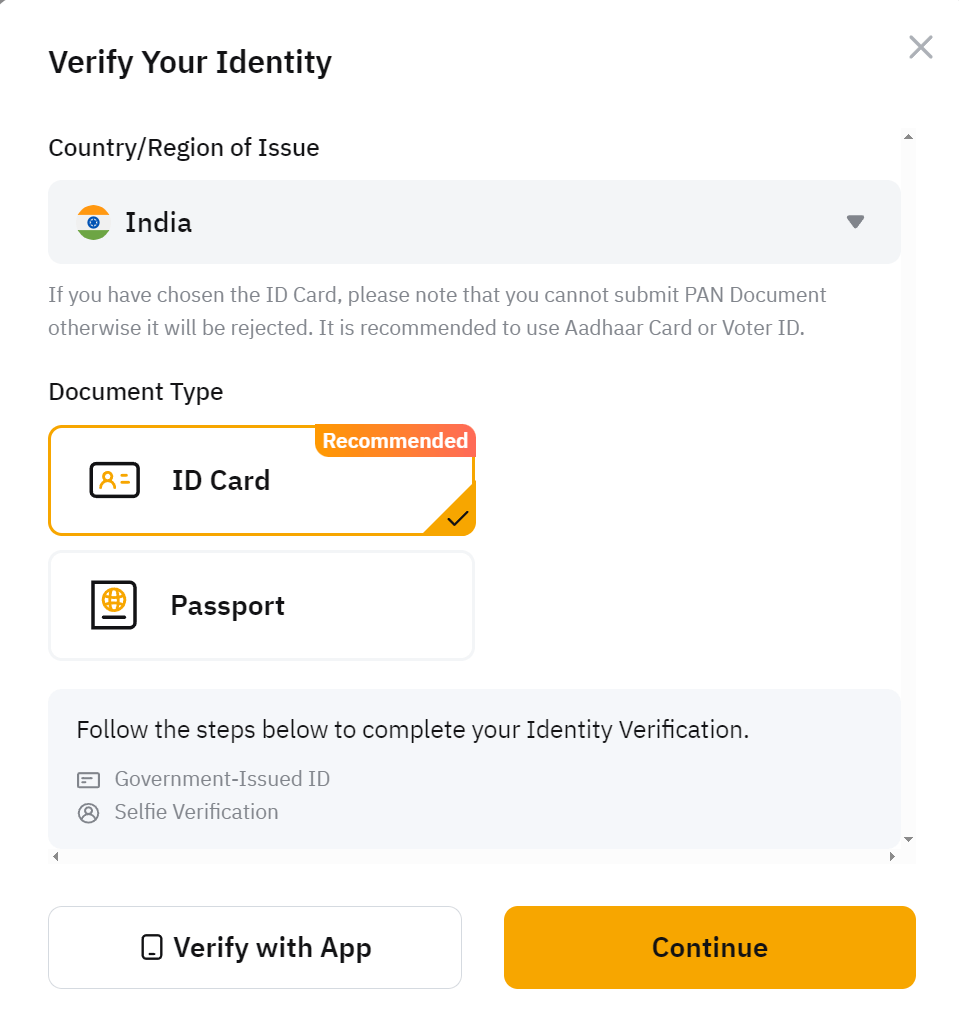

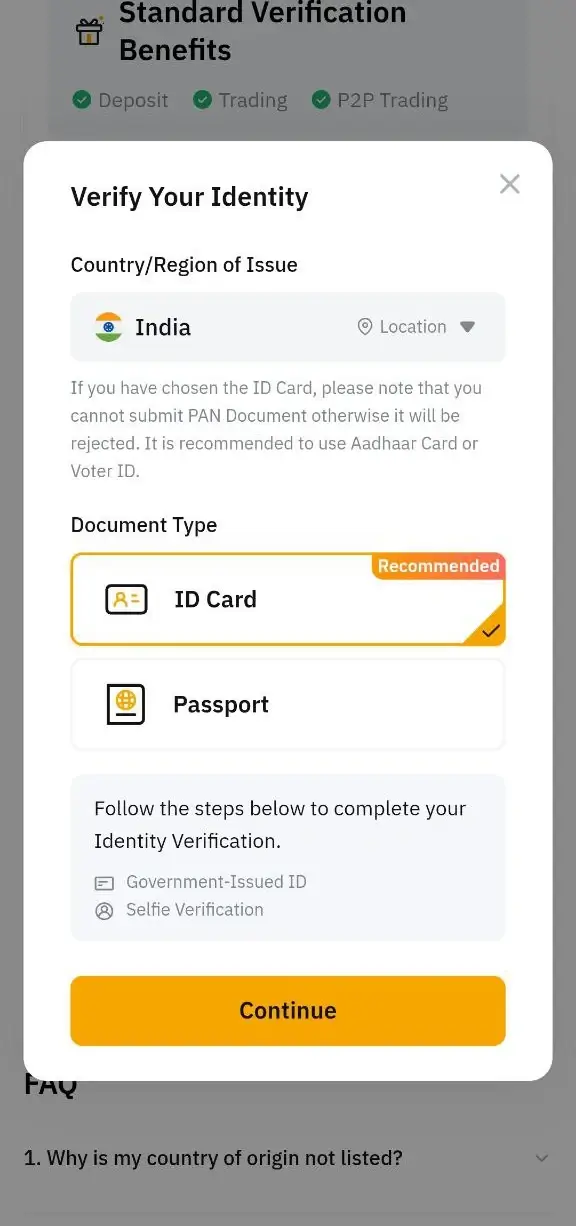

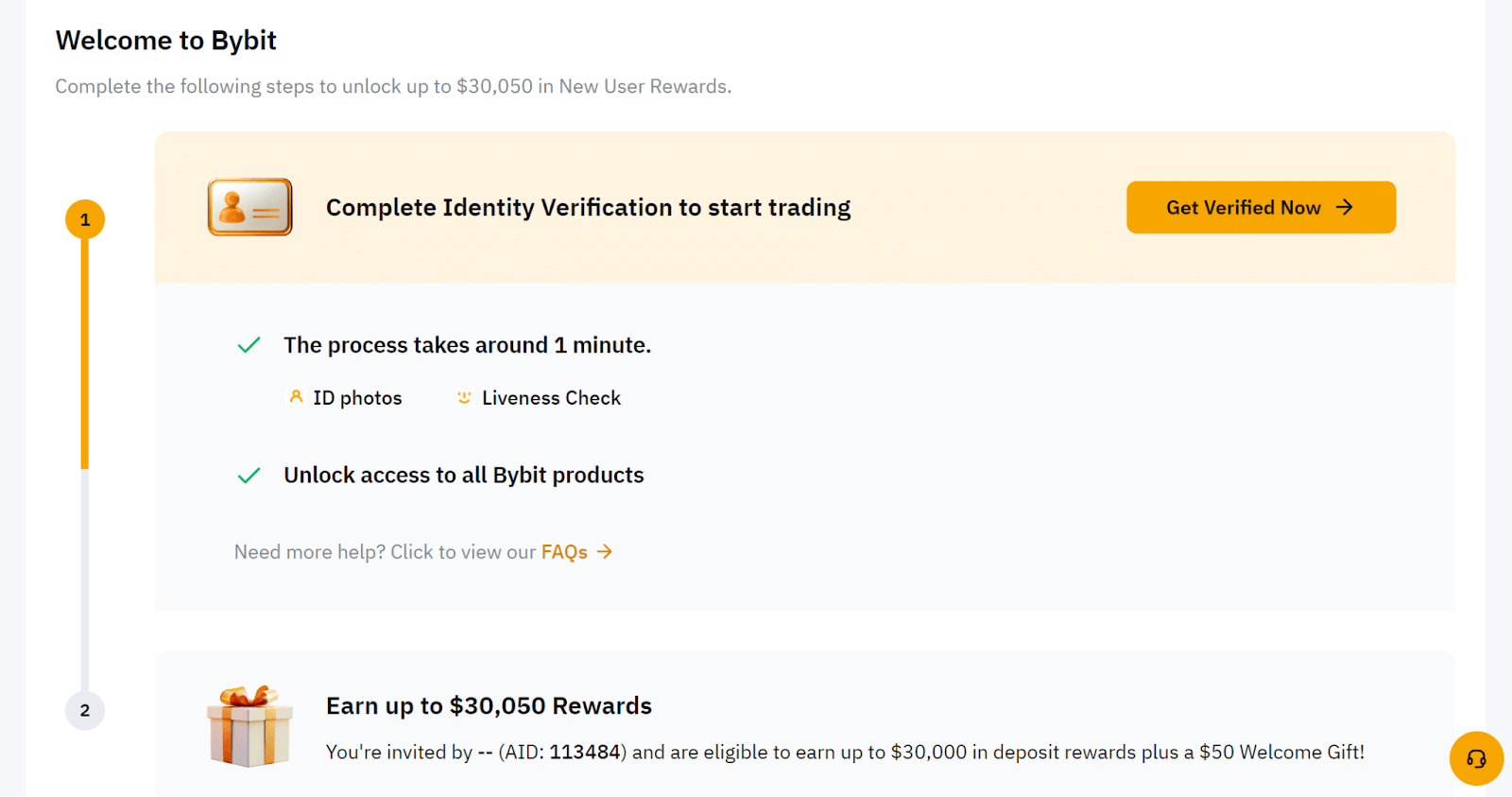

Bybit India operates as a regulated centralized exchange, which requires Know Your Customer (KYC) verification to comply with financial regulations and prevent fraud. Bybit offers two KYC levels:

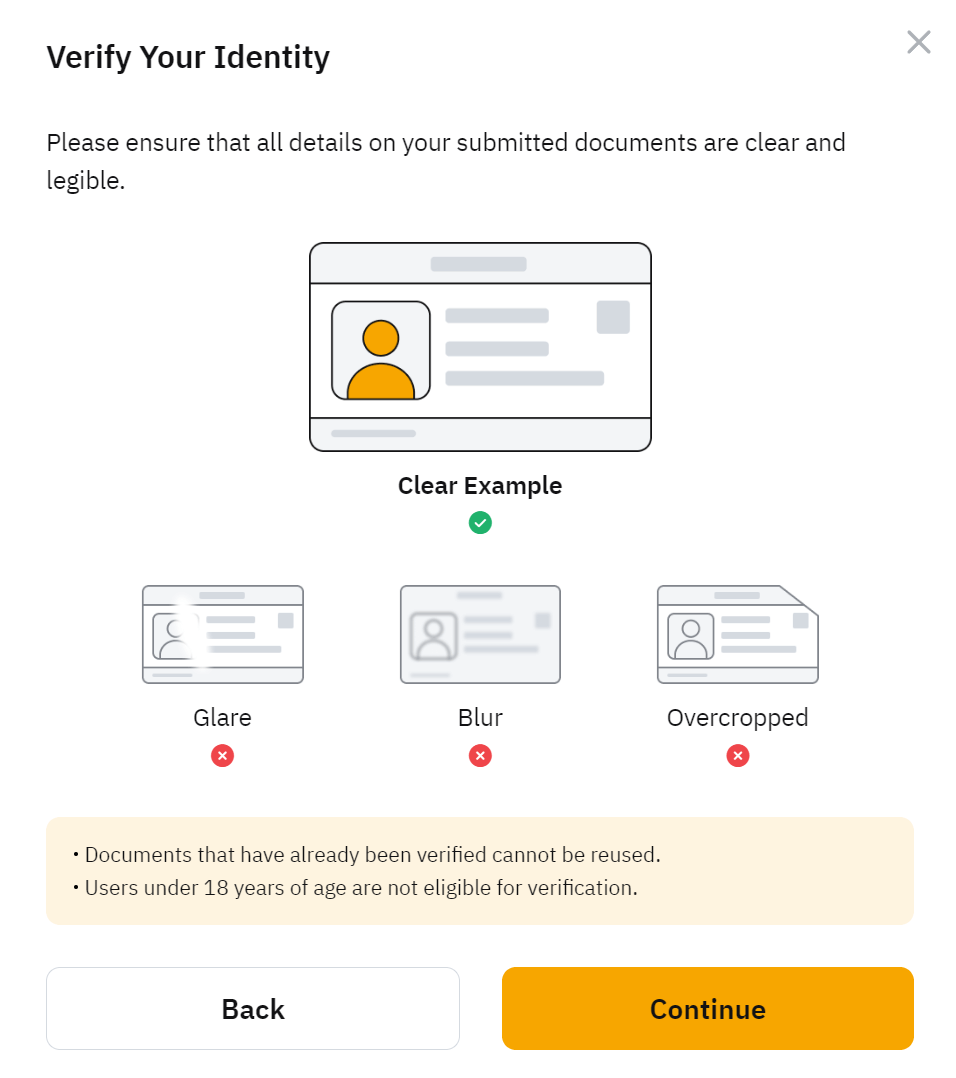

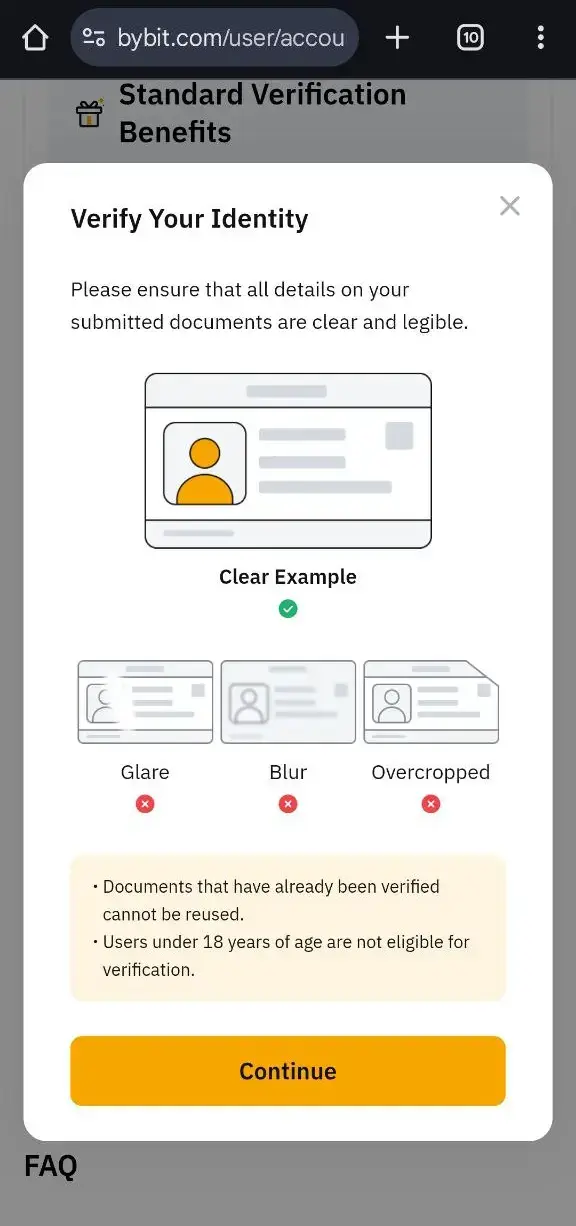

How to Complete KYC Verification on Bybit India:

Why Should You Complete KYC on Bybit India?

Completing KYC verification on Bybit India offers several key benefits for traders:

By completing KYC on Bybit India, you'll be able to access a wider range of services and features, ensuring a better and safer trading experience.

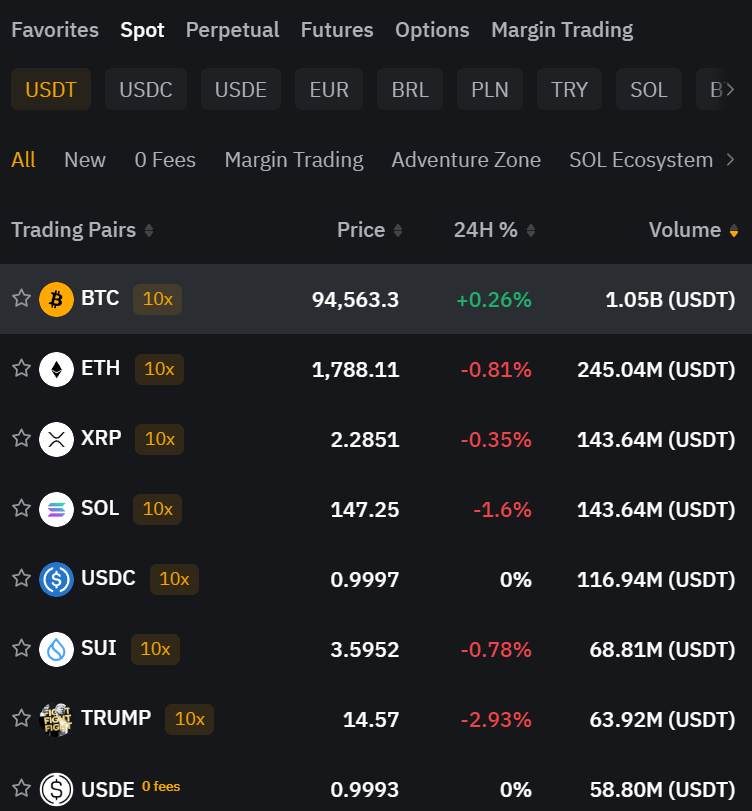

Bybit India uses a maker-taker fee model, which distinguishes between the roles of market makers and takers. Makers add liquidity by placing orders, while takers remove liquidity by filling those orders. Here's a breakdown of the trading fees based on the type of trading:

Bybit India offers a VIP tier system that allows traders to benefit from reduced fees. The discount is based on the user's 30-day trading volume and asset balance. As traders reach higher VIP levels, they unlock progressively lower fees, enhancing the cost-efficiency of their trades.

| VIP Level | Spot Maker Fee | Spot Taker Fee | Futures Maker Fee | Futures Taker Fee |

|---|---|---|---|---|

| VIP 0 | 0.1% | 0.18% | 0.036% | 0.1% |

| VIP 1 | 0.065% | 0.14% | 0.033% | 0.073% |

| VIP 2 | 0.06% | 0.12% | 0.029% | 0.068% |

| VIP 3 | 0.055% | 0.1% | 0.025% | 0.064% |

| VIP 4 | 0.04% | 0.08% | 0.012% | 0.03% |

Free via P2P, bank transfers may have transaction fees.

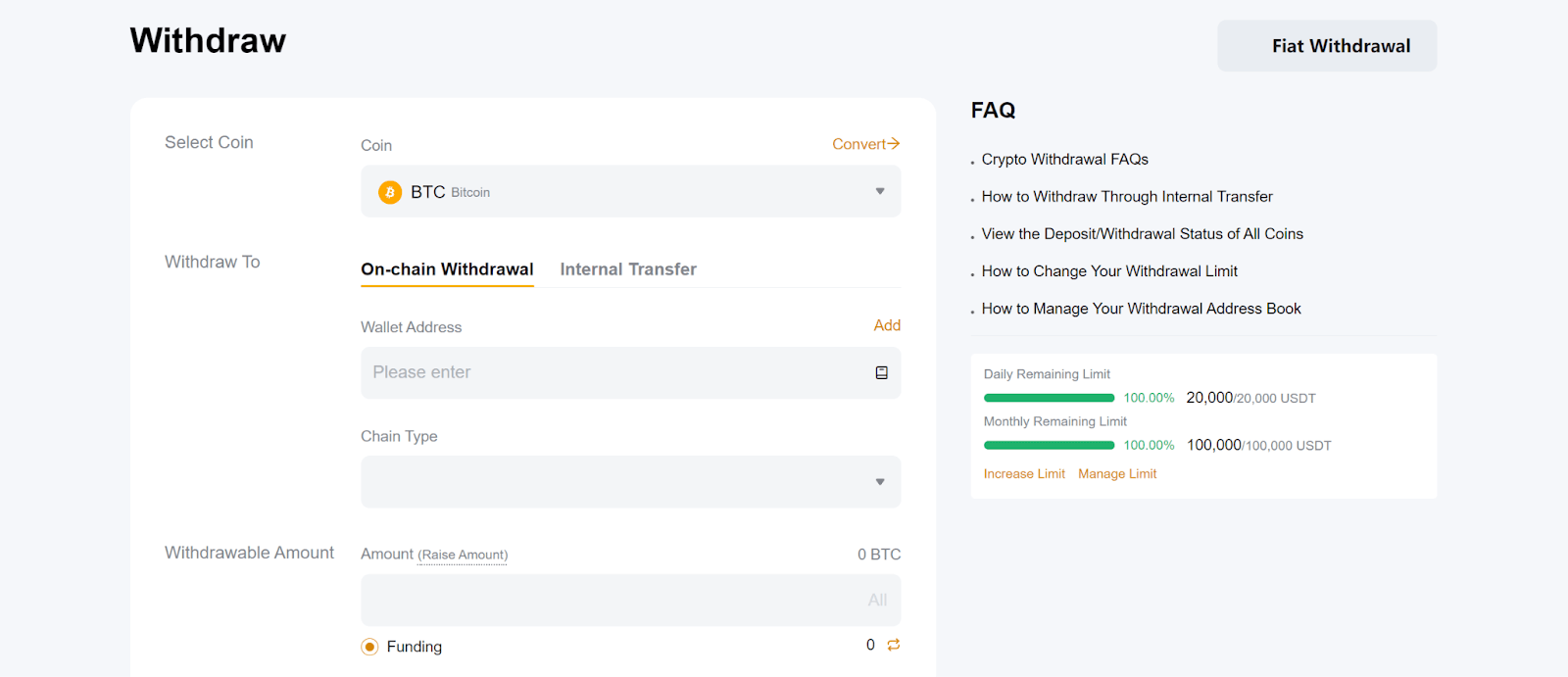

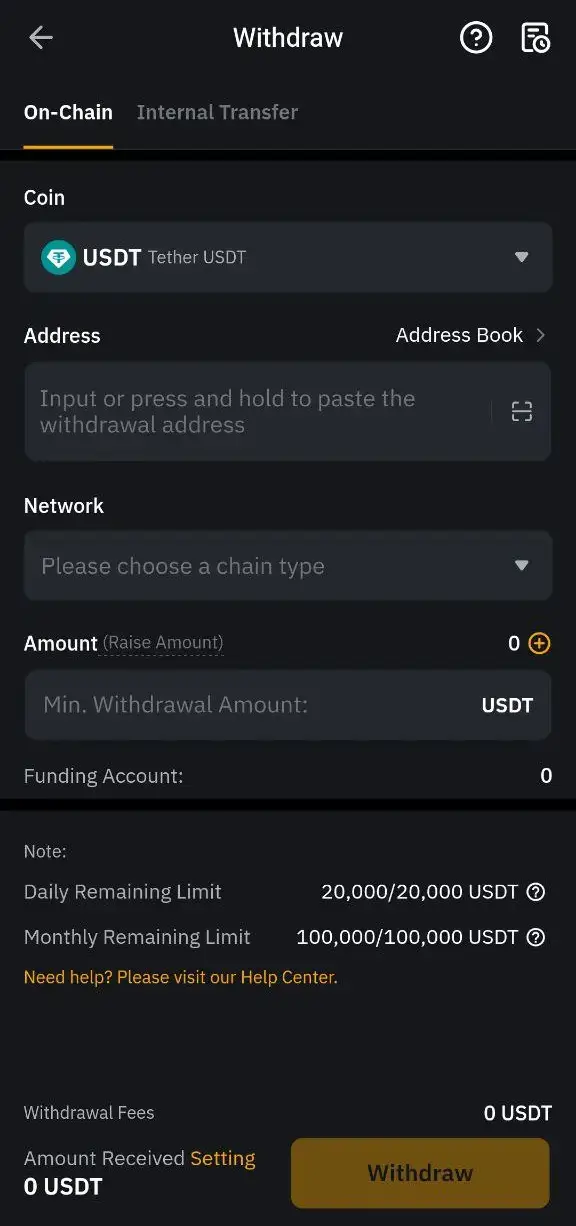

Fees depend on the blockchain network (e.g., BTC withdrawal ~ 0.00011 BTC).

Vary by payment provider, usually between 0.08% – 2%.

Bybit prioritizes security through a multi-layered protection system:

Notably, Bybit consistently publishes its Proof of Reserves audit results, promoting transparency for traders. This practice enables users to confidently verify that their assets are fully backed at all times.

Remarkably, the platform has never suffered a major security breach and proudly maintains a high AA security rating from independent auditors.

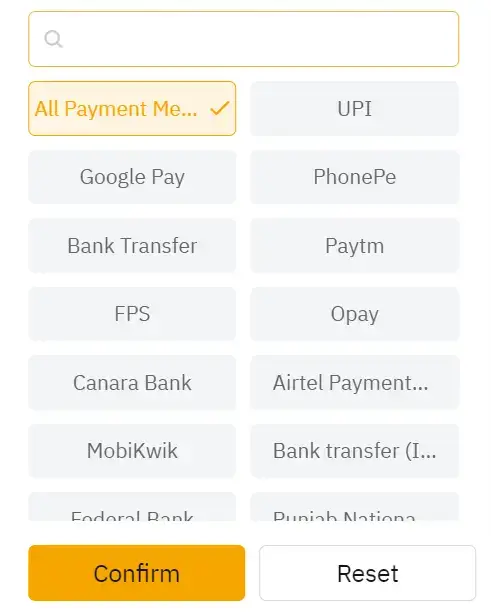

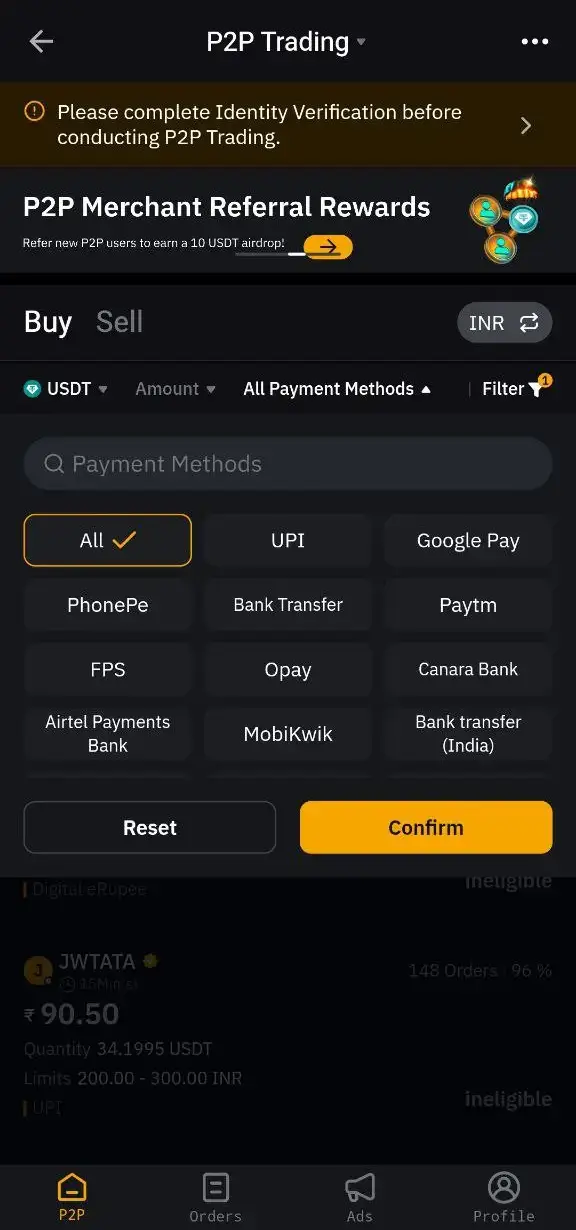

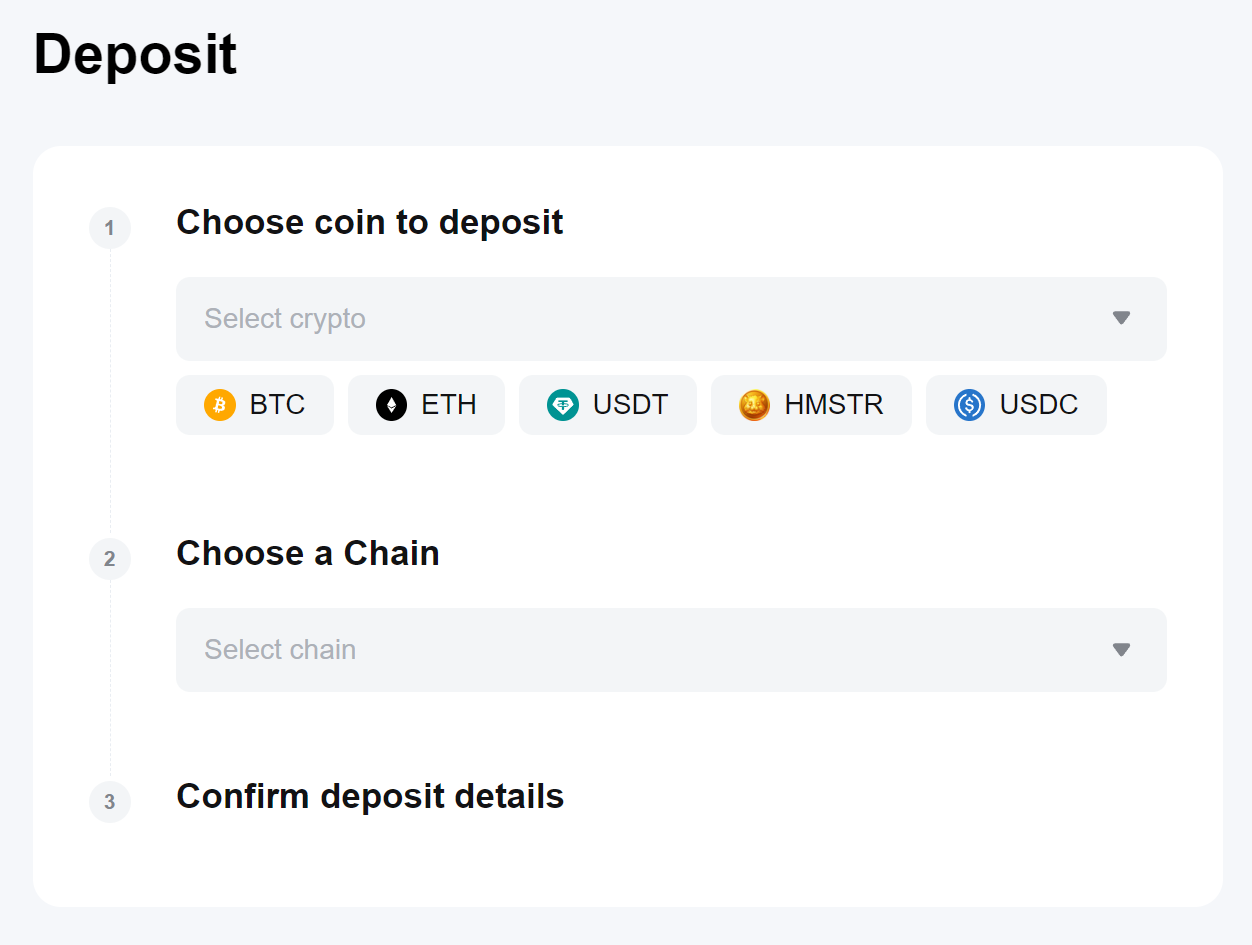

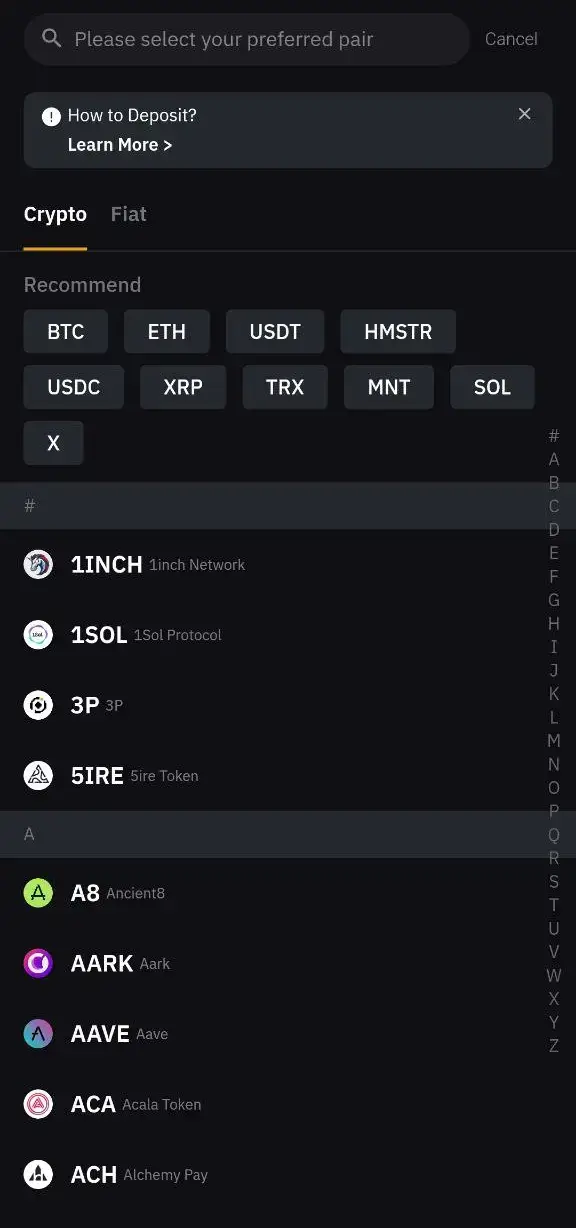

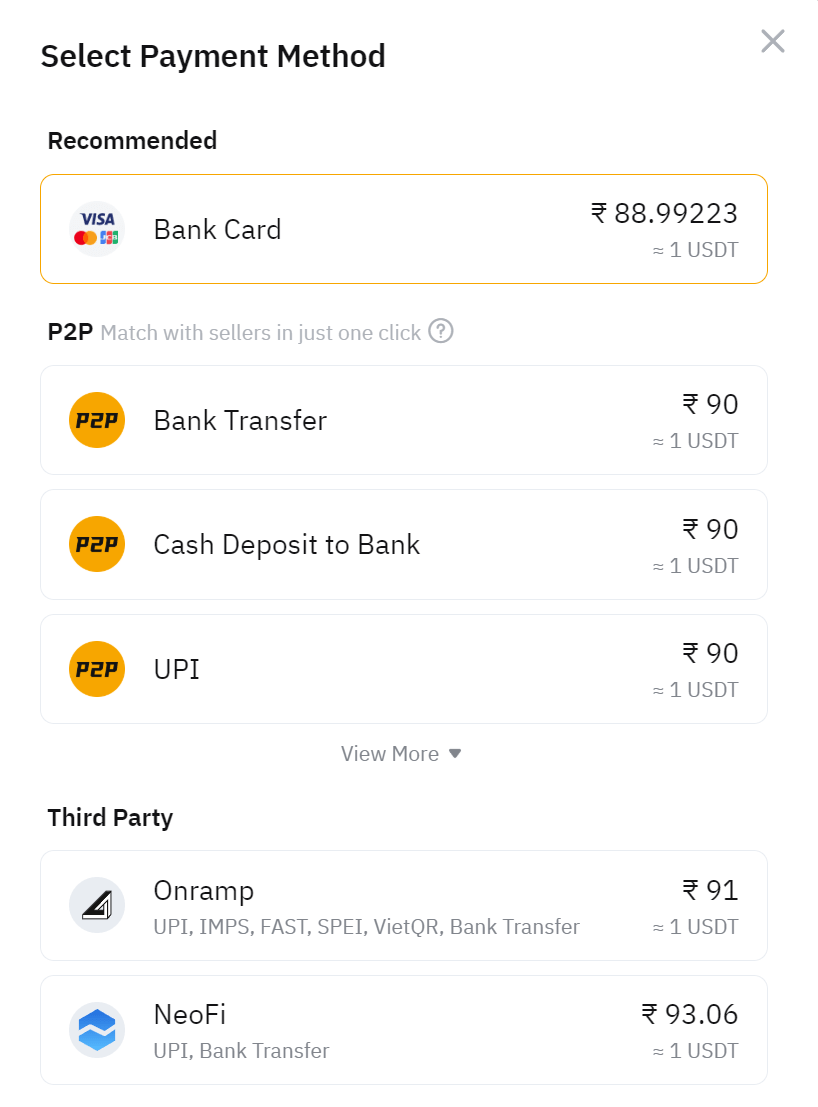

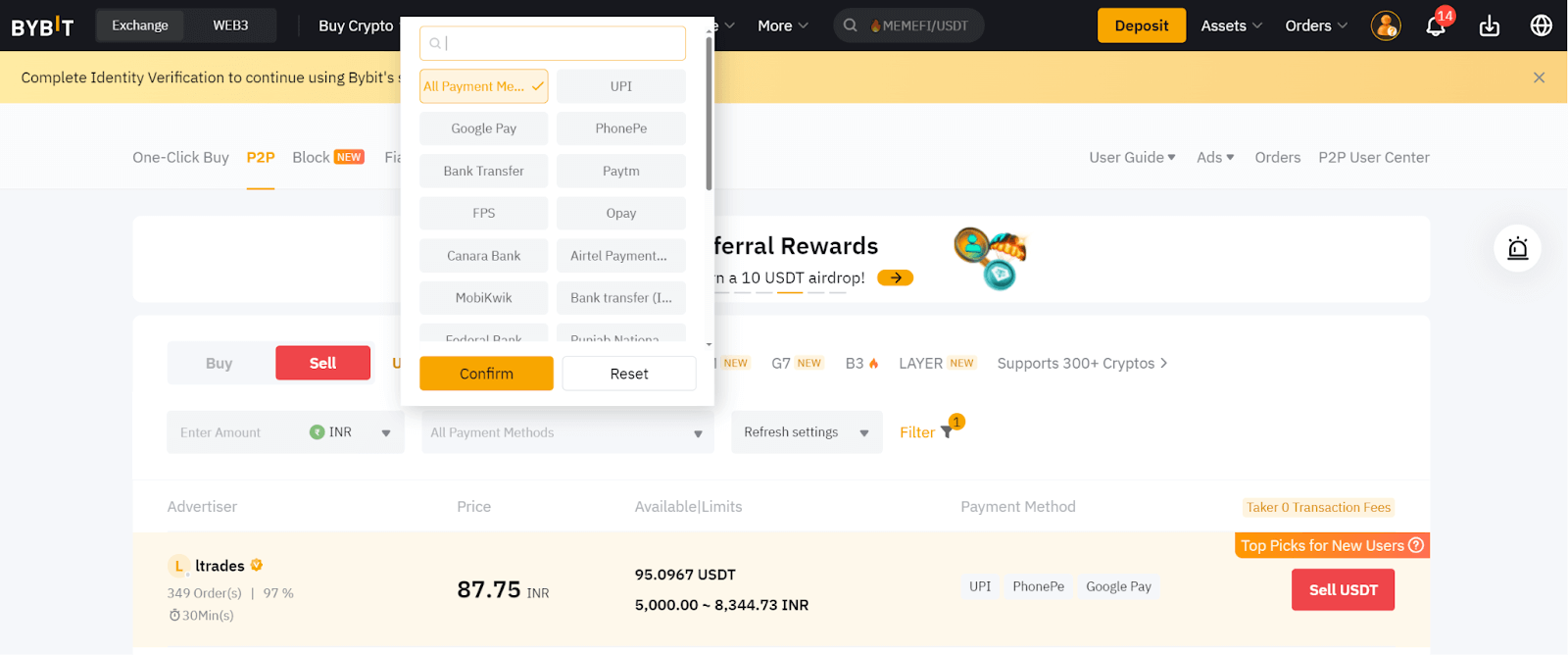

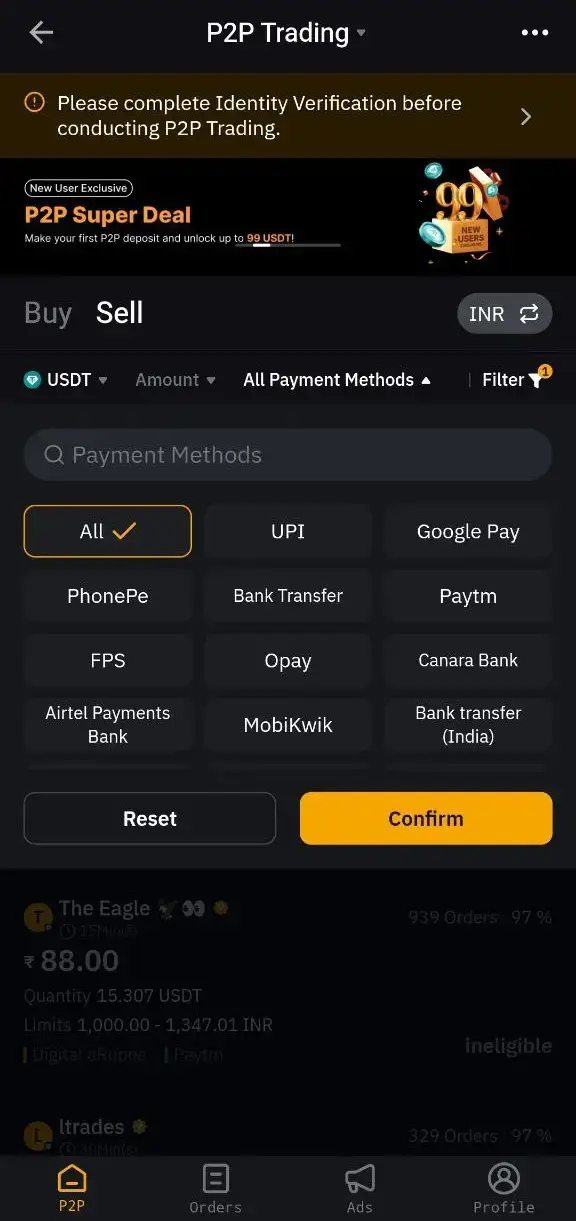

Bybit India simplifies funding for Indian traders through its P2P trading platform, supporting INR deposits via UPI, IMPS, NEFT, and RTGS. As one of the best crypto exchanges in India, Bybit India ensures secure and fast transactions tailored to local needs.

Use P2P trading to deposit INR for free via UPI or bank transfers. Buy USDT or other cryptocurrencies from verified sellers with confidence.

Transfer Bitcoin, Ethereum, or other cryptocurrencies to your Bybit account at no cost.

Bybit India partners with Banxa, Onramp, NeoFi, MoonPay, and Mercuryo for quick fiat-to-crypto purchases using cards or bank transfers.

Complete the Bybit KYC process for higher withdrawal limits and check Bybit fees explained in the fees section.

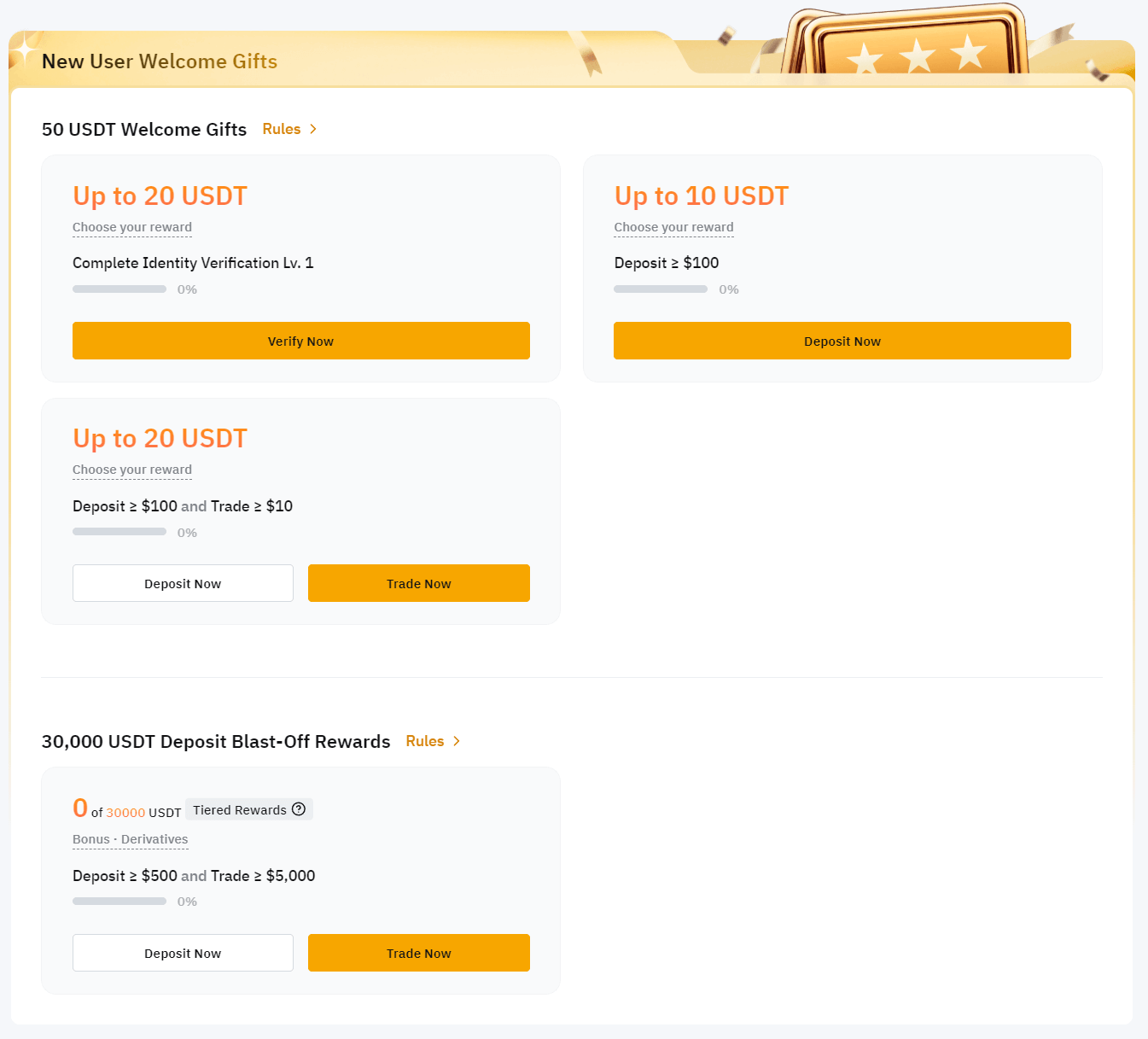

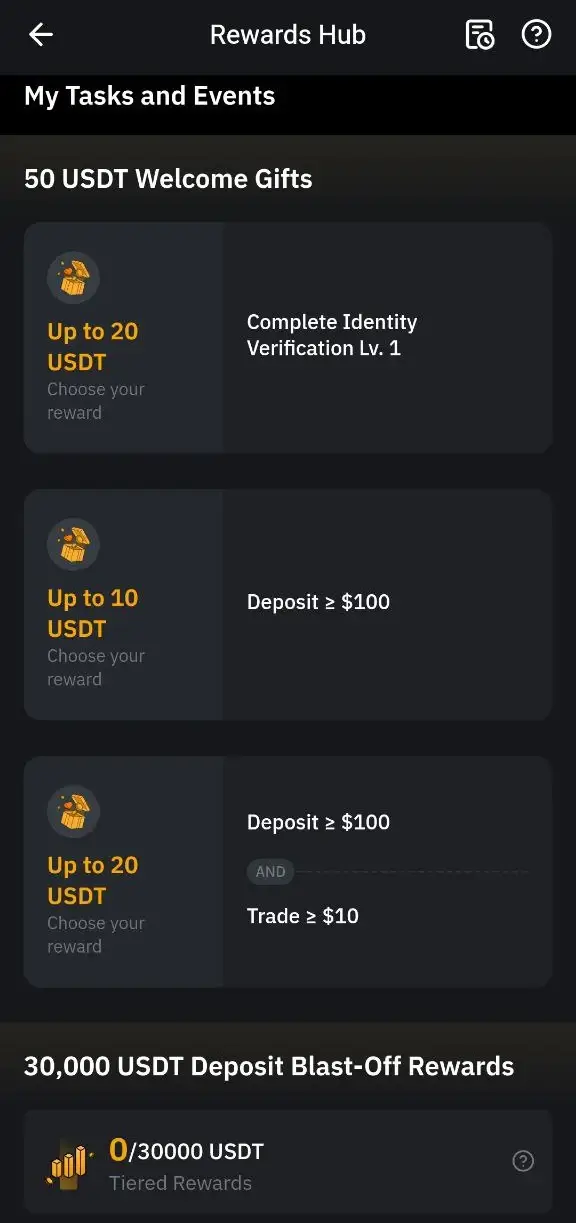

Bybit India provides exciting promotions to enhance your trading. For instance, Indian traders can access rewards tailored to their needs.

Sign up on Bybit India and deposit $100 to claim a $20 welcome bonus, perfect for crypto trading for beginners in India.

Earn up to $500 in bonuses by trading specific volumes, plus enjoy trading fee rebates and cashback.

Complete tasks like KYC or trading challenges to unlock USDT bonuses and exclusive NFTs via the Bybit NFT marketplace.

Invite friends to Bybit and earn up to 30% commission on their trading fees.

High-volume traders get lower fees, priority support, and access to staking rewards and special promotions.

| Feature | Bybit | Binance | OKX | WazirX |

|---|---|---|---|---|

| Trading Fees | Lower than Binance | Standard | Competitive | Higher |

| P2P INR Trading | More options | Limited | Good | Best |

| Leverage | Up to 100x | Up to 125x | Up to 75x | Up to 10x |

| KYC Requirements | Required for full access | Required | Required | Mandatory |

| Security Rating | High | Very High | High | Medium |

| Supported Cryptos | 1,650+ | 350+ | 1,240+ | 250+ |

| Futures Trading | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No |

| Spot Trading | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Staking | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Copy Trading | ✅ Yes | ❌ No | ✅ Yes | ❌ No |

| Fiat On-Ramp | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Mobile App Rating | 4.6/5 (Android), 4.7/5 (iOS) | 4.5/5 (Android), 4.6/5 (iOS) | 4.4/5 (Android), 4.5/5 (iOS) | 4.2/5 (Android), 4.3/5 (iOS) |

| Regulatory Compliance | Registered in Dubai, Cyprus | Registered in multiple jurisdictions | Registered in Seychelles | India-based |

Honestly, Bybit stands out as a beginner-friendly and cost-effective crypto exchange, particularly for Indian traders looking to dive into the market with ease. Unlike Binance, which can feel overwhelming with its complex fee structures and limited INR deposit options, Bybit makes things refreshingly simple. It offers seamless P2P INR trading and a clear maker-taker fee model that’s easy to grasp, even if you’re just starting out.

On the other hand, OKX brings some serious competition with its trading features, but Bybit pulls ahead with its superior AA security rating and a broader selection of trading pairs—perfect for traders who want more options. Meanwhile, WazirX, while tailored for India, often falls short with higher fees and lower leverage limits , making Bybit the go-to for active traders craving flexibility and value.

In short, if you’re an Indian trader hunting for a secure, affordable, and user-friendly platform, Bybit’s got you covered. Ready to kickstart your crypto journey? Sign up with Bybit and explore its welcome bonus to hit the ground running!

Is Bybit legal in India?

+Yes, Bybit operates legally in India, but traders must comply with crypto tax regulations and KYC requirements set by local authorities.

Does Bybit require KYC?

+Yes, KYC is mandatory for most trading and withdrawal activities. Without KYC, withdrawal limits are significantly lower.

What are the trading fees on Bybit?

+Bybit offers low trading fees, with a 0.1% maker/taker fee for spot trading and 0.02% maker / 0.06% taker fee for futures trading.

Can I withdraw INR from Bybit?

+Yes, INR withdrawals are possible via P2P trading, where users can sell USDT or other stablecoins for INR.

How secure is Bybit?

+Bybit employs cold storage, multi-signature wallets, 2FA, and an insurance fund to ensure user security.

Is there a Bybit mobile app?

+Yes, Bybit has a highly-rated mobile app available on Android and iOS, offering full trading functionality, real-time market data, advanced charting tools, and Web3 wallet integration.

How can I withdraw funds from Bybit in India?

+You can withdraw INR via P2P trading by selling USDT or other cryptocurrencies and receiving payment through UPI, IMPS, or bank transfer.

What payment methods does Bybit support?

+Bybit supports cryptocurrency deposits, P2P trading, and payments via third-party providers such as Banxa, MoonPay, and Mercuryo.

Do I need to pay taxes on crypto trading on Bybit in India?

+Yes, India imposes a 30% tax on crypto profits and a 1% TDS on transactions above a certain threshold.

Does Bybit support NFT trading?

+Yes, Bybit offers an NFT marketplace where users can buy, sell, and trade NFTs.

Is Bybit safe for storing cryptocurrency?

+Bybit uses cold storage, multi-layered security, and two-factor authentication to protect user funds.

What are the deposit and withdrawal fees on Bybit?

+Crypto deposits are free, while withdrawal fees depend on the blockchain network (e.g., 0.0005 BTC for BTC withdrawals). Fiat deposits via P2P are free, but third-party services may charge fees.

Can I trade on Bybit without KYC verification?

+Yes, but with limited functionality. Without KYC, the daily withdrawal limit is 20,000 USDT, and access to some features is restricted.

Bybit operates legally in India, but traders must comply with local tax regulations and legal requirements. Here are key aspects to consider:

India imposes a 30% tax on profits from cryptocurrency trading.

A 1% TDS (Tax Deducted at Source) is applicable on crypto transactions above a certain threshold.

Traders must declare their crypto holdings during annual tax filings to comply with Indian financial regulations.

The Reserve Bank of India (RBI) does not recognize crypto as legal tender, but trading is permitted.

The Securities and Exchange Board of India (SEBI) has issued warnings on crypto investments, advising traders to exercise caution.

Banks may impose restrictions on transactions related to cryptocurrency, so P2P and third-party payment methods are commonly used.

Bybit continues to comply with global financial regulations and is expanding fiat-to-crypto services where legally possible.

Remarkably, Bybit has solidified its position as a premier cryptocurrency exchange, delivering impressively low trading fees, exceptional liquidity, and a cutting-edge trading platform. With a diverse array of trading options—think spot, futures, and even copy trading—it’s no surprise that Bybit is a go-to choice for both newcomers dipping their toes in crypto and seasoned traders navigating the markets with confidence.

What’s more, Bybit takes security seriously. Robust measures like cold storage, two-factor authentication (2FA), and transparent Proof-of-Reserves audits create a fortress-like environment for your assets. Plus, the platform’s got your back with round-the-clock customer support, a sleek mobile app that’s a breeze to use, and plenty of fiat on-ramp options, making it especially appealing for Indian traders looking for a reliable hub.

Admittedly, Bybit faces some regulatory hurdles in certain countries, but that hasn’t dimmed its shine as a trusted and forward-thinking exchange for crypto enthusiasts worldwide. Feeling inspired to jump in? Sign up today and grab your welcome bonus to kickstart your trading journey!